Unlocking The Meaning Of Pty Ltd In Australia

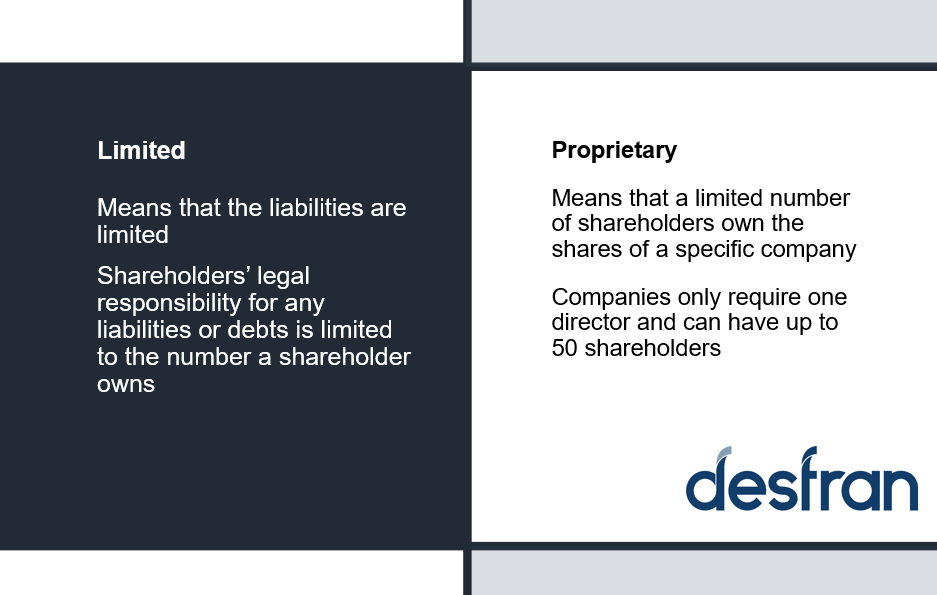

Pty Ltd Australia Meaning: A Pty Ltd or Proprietary Limited is a noun that refers to a type of private company in Australia.

It offers numerous benefits, including limited liability for shareholders and flexibility in operations. Historically, Pty Ltds gained prominence in the 20th century, influencing Australia's business landscape and financial growth.

This article delves into the intricacies of Pty Ltd companies in Australia, exploring their formation, governance, and legal implications.

Pty Ltd Australia Meaning

Understanding the concept of Pty Ltd Australia Meaning involves examining key aspects related to private companies in Australia.

- Formation: Process of establishing a Pty Ltd company.

- Governance: Rules and regulations guiding the operation of the company.

- Liability: Limited liability protection for shareholders.

- Taxation: Tax implications and obligations for Pty Ltd companies.

- Compliance: Legal and regulatory requirements for Pty Ltds.

- Dissolution: Process of winding up or closing down a Pty Ltd company.

- Advantages: Benefits of operating as a Pty Ltd company.

- Disadvantages: Potential drawbacks of the Pty Ltd structure.

These aspects provide a comprehensive understanding of Pty Ltd companies in Australia, enabling individuals to make informed decisions regarding business formation and operation.

Formation

Understanding the formation process of a Pty Ltd company is crucial to comprehending its overall meaning and implications. The formation process establishes the legal framework and foundation upon which the company operates, determining its structure, governance, and operations. Without proper formation, a Pty Ltd company cannot exist or function effectively.

Real-life examples abound, demonstrating the practical significance of the formation process. For instance, a Pty Ltd company must be registered with the Australian Securities and Investments Commission (ASIC) to gain legal recognition and operate lawfully. This registration process involves submitting various documents and meeting specific requirements, ensuring compliance with Australian business regulations.

The formation process also determines the company's governance structure, including the appointment of directors, shareholders, and the allocation of responsibilities. This governance framework shapes the decision-making process, risk management, and overall management of the company. A well-defined formation process helps avoid legal disputes, ensures transparency, and facilitates efficient operations.

Governance

Governance structures and regulations play a pivotal role in defining the pty ltd australia meaning. They establish the framework for decision-making, risk management, and overall operations within a Pty Ltd company. Without clear governance guidelines, a Pty Ltd company could face legal challenges, inefficiencies, and potential financial losses.

Governance encompasses various aspects, including the roles and responsibilities of directors, shareholders, and management; the processes for making decisions; and the systems for internal control and compliance. A well-defined governance structure ensures that the company operates in a transparent, accountable, and ethical manner, protecting the interests of all stakeholders.

Real-life examples illustrate the practical significance of governance in Pty Ltd companies. For instance, a Pty Ltd company that fails to comply with its governance obligations may face penalties or even legal action. Conversely, a Pty Ltd company with a strong governance framework can attract investors, secure financing, and establish a positive reputation in the market.

Understanding the connection between governance and the pty ltd australia meaning is crucial for directors, shareholders, and managers of Pty Ltd companies. It helps them fulfill their legal obligations, make informed decisions, and navigate the regulatory landscape effectively. By embracing sound governance practices, Pty Ltd companies can maximize their potential for success and minimize potential risks.

Liability

Within the spectrum of pty ltd australia meaning, the concept of Liability: Limited liability protection for shareholders holds immense significance. It's a cornerstone of Pty Ltd companies, offering distinct advantages that shape their operations and risk profile.

- Shareholder Protection: Shareholders' personal assets are shielded from business liabilities. This protection encourages investment and innovation, fostering economic growth.

- Company Autonomy: The company's legal identity is separate from its shareholders. This distinction allows for independent decision-making and continuity, even with changes in ownership.

- Risk Management: Limited liability incentivizes prudent financial management, as shareholders are not personally liable for business debts or obligations.

- Creditor Confidence: Knowing that shareholders have limited liability, creditors are more likely to extend credit to Pty Ltd companies, facilitating access to capital.

These facets intertwine to define the pty ltd australia meaning, providing a framework for understanding the legal and financial implications of operating a Pty Ltd company. This limited liability protection empowers shareholders, promotes economic activity, and contributes to the stability of the Australian business landscape.

Taxation

Within the multifaceted landscape of pty ltd australia meaning, the aspect of Taxation: Tax implications and obligations for Pty Ltd companies holds significant weight. Understanding these tax considerations is paramount for comprehending the financial responsibilities and implications of operating a Pty Ltd company in Australia.

- Tax Structure: Pty Ltd companies are subject to Australia's corporate tax system, including income tax, goods and services tax (GST), and fringe benefits tax (FBT).

- Tax Rates: The corporate tax rate in Australia is currently 30%. Pty Ltd companies may also be liable for additional taxes, such as GST and FBT.

- Tax Obligations: Pty Ltd companies are required to lodge annual tax returns and pay taxes in accordance with Australian tax laws. Failure to comply with these obligations can result in penalties.

- Tax Planning: Effective tax planning is crucial for Pty Ltd companies to minimize their tax liability and maximize their profitability.

These facets of taxation are intricately intertwined with the pty ltd australia meaning, shaping the financial landscape and decision-making processes of Pty Ltd companies. By understanding and adhering to their tax obligations, Pty Ltd companies can operate efficiently, minimize risks, and contribute to the Australian economy.

Compliance

Within the comprehensive framework of pty ltd australia meaning, the aspect of Compliance: Legal and regulatory requirements for Pty Ltds. stands as a cornerstone, shaping the very foundation and operation of these companies. Pty Ltds are obligated to adhere to a comprehensive array of legal and regulatory requirements, ensuring their conduct aligns with Australian business standards and ethical practices.

Compliance encompasses a vast spectrum of responsibilities, including adhering to taxation laws, meeting financial reporting obligations, maintaining proper corporate governance practices, and complying with industry-specific regulations. By fulfilling these requirements, Pty Ltds demonstrate their commitment to transparency, accountability, and ethical business conduct. Failure to comply can result in severe consequences, including fines, penalties, and even legal action.

Real-life examples abound, illustrating the practical significance of compliance within the pty ltd australia meaning. For instance, a Pty Ltd company that fails to meet its tax obligations may face substantial financial penalties. Conversely, a Pty Ltd company that maintains a strong compliance culture is more likely to attract investors, secure financing, and establish a positive reputation in the marketplace.

Understanding the connection between compliance and the pty ltd australia meaning is crucial for directors, shareholders, and managers of Pty Ltd companies. It empowers them to make informed decisions, navigate the regulatory landscape effectively, and avoid potential legal and financial risks. By embracing a culture of compliance, Pty Ltd companies can maximize their potential for success and contribute to the integrity and stability of the Australian business environment.

Dissolution

Within the comprehensive framework of pty ltd australia meaning, the aspect of Dissolution: Process of winding up or closing down a Pty Ltd company. holds significant importance, representing the final chapter in the life of a company. Dissolution involves a series of legal and administrative steps taken to formally end the existence of a Pty Ltd company, distributing its assets and liabilities in accordance with the law.

- Initiation: The process of dissolution can be initiated voluntarily by the shareholders or directors of the company, or involuntarily by a court order.

- Liquidation: A liquidator is appointed to oversee the dissolution process, including the sale of company assets and distribution of proceeds to creditors and shareholders.

- Deregistration: Once all debts and obligations have been settled, the company is formally deregistered with the Australian Securities and Investments Commission (ASIC), marking the end of its legal existence.

- Tax Implications: Dissolution triggers various tax implications, including capital gains tax on the sale of assets and income tax on any remaining profits.

Understanding the process of dissolution is crucial for directors and shareholders of Pty Ltd companies, as it ensures an orderly and compliant winding up of the company's affairs. Proper dissolution procedures safeguard the interests of creditors, shareholders, and other stakeholders, while also ensuring that the company's legal obligations are met. By carefully navigating the dissolution process, Pty Ltd companies can conclude their operations in a responsible and efficient manner.

Advantages

Within the context of "pty ltd australia meaning," the topic of "Advantages: Benefits of operating as a Pty Ltd company" assumes great significance. The advantages associated with Pty Ltd companies are not merely incidental but rather form an integral part of their conceptualization and practical value within the Australian business landscape.

The benefits of operating as a Pty Ltd company are multifaceted, encompassing factors such as limited liability protection for shareholders, tax efficiency, flexibility in operations, and enhanced credibility. These advantages serve as key drivers for individuals and businesses choosing to establish a Pty Ltd company, shaping the overall meaning and purpose of this business structure in Australia.

Real-life examples abound, demonstrating the practical applications of these advantages. For instance, the limited liability protection afforded to Pty Ltd companies encourages entrepreneurs to take calculated risks, fostering innovation and economic growth. The tax advantages, such as the ability to claim certain business expenses and distribute profits to shareholders in a tax-effective manner, contribute to the financial viability and profitability of Pty Ltd companies.

Understanding the connection between "Advantages: Benefits of operating as a Pty Ltd company" and "pty ltd australia meaning" is crucial for aspiring business owners, investors, and stakeholders alike. It empowers them to make informed decisions about the choice of business structure, aligning their objectives with the benefits offered by a Pty Ltd company. By carefully considering these advantages and their implications, individuals can maximize the potential of their business ventures within the Australian market.

Disadvantages

Delving into the complexities of "pty ltd australia meaning" necessitates an examination of potential drawbacks associated with the Pty Ltd structure. These disadvantages, while not insurmountable, offer valuable insights into the limitations and considerations that come with this business entity.

- Limited fundraising options: Unlike public companies, Pty Ltd companies have limited options for raising capital. They cannot issue shares to the public, which can hinder their ability to grow and expand.

- Double taxation: Profits generated by a Pty Ltd company are subject to corporate tax at the company level and personal income tax when distributed to shareholders as dividends. This double taxation can impact the overall profitability of the company.

- Personal liability for directors: In some circumstances, directors of a Pty Ltd company may be held personally liable for the company's debts and obligations. This personal risk can be a deterrent for individuals considering the Pty Ltd structure.

- Complex compliance requirements: Pty Ltd companies are subject to various compliance requirements, including annual reporting, financial audits, and tax obligations. These requirements can be time-consuming and costly to manage.

Understanding these potential drawbacks is crucial when evaluating the "pty ltd australia meaning" and making informed decisions about the choice of business structure. While the Pty Ltd structure offers numerous advantages, it is essential to weigh these against the potential limitations and challenges to determine the most suitable business entity for specific circumstances.

In summary, our exploration of "pty ltd australia meaning" has unveiled the multifaceted nature of this business structure. We've examined its advantages, such as limited liability protection, tax efficiency, and operational flexibility, which have contributed to the popularity of Pty Ltd companies in Australia. However, we've also acknowledged potential drawbacks, including limited fundraising options, double taxation, and compliance requirements, which should be carefully considered when choosing this structure.

As we reflect on the "pty ltd australia meaning," several key points emerge. Firstly, the Pty Ltd structure offers a balance between personal asset protection and business flexibility, making it suitable for a wide range of entrepreneurs and small to medium-sized enterprises. Secondly, the tax implications and compliance requirements associated with Pty Ltd companies are important factors to consider, as they can impact the overall profitability and administrative burden of the business. Thirdly, understanding the advantages and disadvantages of the Pty Ltd structure allows individuals to make informed decisions about the most appropriate business entity for their specific circumstances.

Ryan Fitzpatrick Kids: A Family United Through Love And Support

Who Is Michael Strahan's Wife? Discover Her Identity And Connections

What Happened To RiceGum: Rise, Fall, And Lessons Learned

ncG1vNJzZmirpaWys8DEmqRvZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmaprKliubWwjJqsrKyilrmqrYymnJqmmaO0b7TTpqM%3D