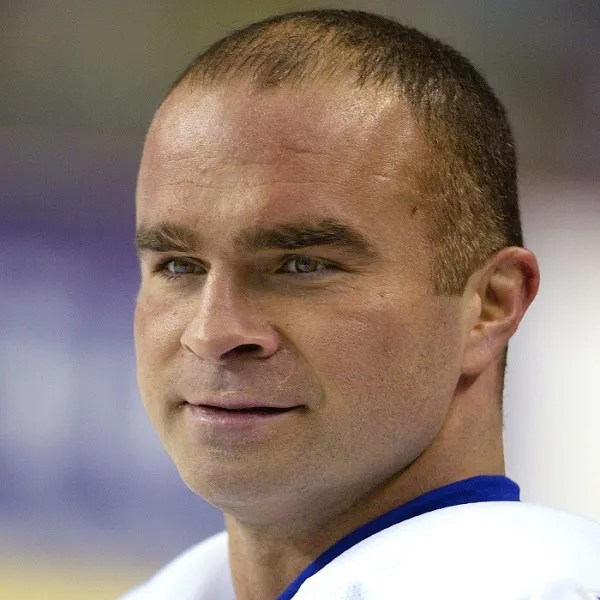

Tips To Understand Tie Domi's Enviable Net Worth

Tie Domi Net Worth, a financial measure, denotes the total value of the assets owned by the Canadian ice hockey player, Tie Domi, minus his liabilities. For instance, if he possesses assets worth $5 million and owes debts of $1 million, his net worth would stand at $4 million.

Assessing an individual's net worth holds significance as it offers insights into their financial well-being. It can influence factors such as loan eligibility, investment opportunities, and overall financial stability. Historically, the concept of net worth has evolved, becoming an essential tool for financial planning and decision-making.

Delving into the specifics of Tie Domi's net worth in this article, we will explore the various income streams that have contributed to his wealth, the investments he has made, and how his net worth has fluctuated over time.

Tie Domi Net Worth

Understanding the various aspects that contribute to Tie Domi's net worth is essential for gaining a comprehensive view of his financial situation. These aspects encompass his income sources, investments, assets, liabilities, and more.

- Salary and bonuses

- Endorsement deals

- Business ventures

- Investments

- Real estate

- Liabilities

- Taxes

- Financial planning

- Net worth fluctuations

- Comparison to other athletes

These aspects provide insights into how Tie Domi has accumulated his wealth, how he manages his finances, and how his net worth has changed over time. By examining these aspects, we can better understand the factors that have shaped his financial success.

Salary and bonuses

Salary and bonuses constitute a significant portion of Tie Domi's net worth, representing his earnings from his professional ice hockey career. These earnings primarily include:

- Base salary: Theamount of money Domi receives from his team as per his contract. This amount is typically negotiated and can vary based on factors such as experience, performance, and market value.

- Bonuses: Performance-based payments tied to specific achievements, such as scoring goals, making assists, or winning championships. These bonuses incentivize strong performance and contribute to Domi's overall earnings.

- Signing bonuses: One-time payments offered to Domi when he signs a new contract with a team. Signing bonuses can be substantial and can significantly impact his net worth.

- Endorsement bonuses: Payments Domi receives from companies for promoting their products or services. These bonuses can be a lucrative source of income for athletes with a large fan base and a positive public image.

Salary and bonuses have been instrumental in shaping Tie Domi's net worth. Throughout his career, he has consistently earned high salaries and bonuses, which have contributed to his financial success. Understanding the components of his salary and bonuses provides valuable insights into the sources of his wealth.

Endorsement deals

Endorsement deals play a crucial role in shaping Tie Domi's net worth. These deals involve partnerships between Domi and various companies, wherein Domi promotes their products or services in exchange for compensation. Endorsement deals can significantly boost an athlete's net worth, as they provide a consistent stream of income beyond their playing salary.

Domi's status as a popular and respected ice hockey player has made him an attractive partner for brands seeking to align themselves with a positive public image. Over the years, he has secured endorsement deals with several notable companies, including Reebok, Bauer Hockey, and Upper Deck. These deals not only increase his net worth but also help raise his profile and expand his reach beyond the rink.

The practical significance of understanding the connection between endorsement deals and Tie Domi's net worth lies in its implications for financial planning and wealth management. Athletes with high net worths often rely on endorsement deals to supplement their income and secure their financial futures. By leveraging their popularity and marketability, they can create multiple income streams and build long-term financial stability.

Business ventures

Business ventures represent a critical component of Tie Domi's net worth, contributing significantly to his overall financial success. Beyond his ice hockey career, Domi has invested in various business ventures that have generated substantial income and expanded his financial portfolio. These ventures demonstrate Domi's entrepreneurial spirit and his ability to leverage his platform and resources to create additional wealth streams.

One notable example of Domi's business ventures is his involvement in the restaurant industry. He co-owns several restaurants in partnership with other investors, including the popular "Tie Domi's Sports Bar" chain. These establishments have become popular destinations among hockey fans and have contributed to Domi's net worth through profits and dividends.

Additionally, Domi has invested in real estate properties, both residential and commercial. These investments have provided rental income, capital appreciation, and potential tax benefits. Domi's understanding of the real estate market and his ability to make sound investment decisions have further bolstered his net worth.

Understanding the connection between business ventures and Tie Domi's net worth highlights the importance of financial diversification and strategic planning. Athletes with high net worths often seek to invest their earnings wisely in order to secure their financial futures and generate passive income. By investing in a variety of business ventures, Domi has reduced his reliance on hockey-related income and created multiple sources of wealth.

Investments

Investments are a cornerstone of Tie Domi's net worth, reflecting his ability to grow his wealth beyond his hockey earnings. His investment portfolio consists of a diverse range of assets, each with its own risk and return profile.

- Stocks: Domi has invested in various publicly traded companies, seeking potential gains from stock appreciation and dividends. These investments provide diversification and the opportunity for long-term growth.

- Bonds: Bonds offer a more conservative investment option, providing fixed income payments over a specified period. Domi's bond investments contribute stability to his portfolio and generate regular cash flow.

- Real Estate: Beyond his personal residences, Domi has invested in residential and commercial properties. Real estate investments offer potential rental income, capital appreciation, and tax benefits.

- Alternative Investments: Domi has also explored alternative investments, such as venture capital and private equity. These investments have the potential for high returns but also carry higher risk.

Tie Domi's investment strategy reflects his financial acumen and willingness to balance risk and reward. His diversified portfolio has contributed significantly to his net worth and provides a solid foundation for his financial future.

Real estate

Real estate constitutes a substantial component of Tie Domi's net worth, contributing to his financial stability and long-term wealth growth. His real estate investments encompass a diverse range of properties, each offering unique benefits and returns.

- Residential properties: Domi owns several residential properties, including his primary residence and rental properties. These investments generate rental income, provide tax benefits, and offer potential capital appreciation.

- Commercial properties: Domi has invested in commercial properties, such as office buildings and retail spaces. These investments offer higher rental yields and have the potential for long-term value appreciation.

- Land: Domi owns undeveloped land, providing opportunities for future development or sale. Land investments can offer potential appreciation and diversification benefits.

- Vacation homes: Domi has invested in vacation homes in desirable locations. These properties provide personal enjoyment and can also generate rental income or capital gains.

Domi's real estate investments demonstrate his savvy investment strategy and understanding of the real estate market. By diversifying his portfolio across different property types and locations, he has mitigated risk and positioned himself for continued wealth growth. The appreciation and rental income generated from his real estate investments have significantly contributed to his overall net worth.

Liabilities

Liabilities play a crucial role in assessing Tie Domi's net worth, representing his financial obligations and debts. Understanding the nature of his liabilities provides a comprehensive view of his financial situation and overall wealth.

- Outstanding Loans: Domi may have outstanding loans, such as mortgages on his properties or personal loans. These loans represent a liability as they require regular payments and accrue interest.

- Unpaid Taxes: Domi is responsible for paying various taxes, including income tax, property tax, and sales tax. Unpaid taxes can accumulate as liabilities, potentially leading to penalties and interest charges.

- Deferred Payments: Certain expenses or payments may be deferred, such as legal fees or agent commissions. These deferred payments create a liability until they are settled.

- Contractual Obligations: Domi may have contractual obligations, such as remaining signing bonuses or endorsement commitments. These obligations represent a liability as they require future payments.

These liabilities impact Tie Domi's net worth by reducing the value of his assets. When liabilities exceed assets, it can lead to a negative net worth. Managing liabilities effectively is essential for Domi's financial well-being and long-term wealth preservation. It involves strategically paying down debts, planning for future obligations, and ensuring that liabilities do not outweigh assets.

Taxes

Taxes are a significant consideration in assessing Tie Domi's net worth, representing his financial obligations to various government entities. These taxes can impact his overall wealth and financial planning, requiring careful management and planning.

- Income Tax: Domi is subject to income tax on his earnings, including salary, bonuses, and endorsement income. The amount of income tax he owes depends on his taxable income and applicable tax rates.

- Property Tax: As a property owner, Domi is responsible for paying property taxes on his residential and commercial properties. These taxes are based on the assessed value of the properties and can vary depending on location and local tax rates.

- Sales Tax: Domi is required to pay sales tax on certain purchases, such as luxury items and real estate transactions. Sales tax rates vary by jurisdiction and can impact his overall expenses.

- Capital Gains Tax: If Domi sells assets, such as stocks or real estate, he may be subject to capital gains tax on the profits. The amount of tax owed depends on the asset's holding period and his applicable tax bracket.

Effectively managing taxes is crucial for Domi's financial well-being. Proper tax planning can help him minimize his tax liability, maximize his net worth, and ensure compliance with tax regulations. Failing to pay taxes can result in penalties, interest charges, and legal consequences.

Financial planning

Financial planning plays a pivotal role in shaping Tie Domi's net worth. It encompasses a range of strategies and decisions aimed at managing his financial resources effectively. Sound financial planning allows Domi to maximize his income, minimize expenses, and build long-term wealth.

A crucial aspect of financial planning for Domi is managing his income streams. This involves negotiating favorable contracts, securing endorsement deals, and making wise investment decisions. Domi's financial advisors carefully assess his earning potential and guide him towards opportunities that align with his financial goals.

Financial planning also involves managing expenses and liabilities. Domi's financial team monitors his spending patterns, identifies areas for optimization, and implements strategies to reduce unnecessary expenses. Additionally, they manage his debt obligations, ensuring that his liabilities do not outweigh his assets and jeopardize his financial stability.

The practical significance of financial planning for Tie Domi's net worth cannot be overstated. By implementing sound financial strategies, Domi has accumulated substantial wealth, secured his financial future, and achieved his long-term financial objectives. His financial planning serves as a blueprint for athletes and individuals seeking to manage their finances effectively.

Net worth fluctuations

Net worth, a measure of financial well-being, is subject to fluctuations over time, and Tie Domi's net worth is no exception. These fluctuations can be attributed to various factors, including changes in income, expenses, and investments.

- Income Fluctuations: Domi's income primarily comes from hockey-related activities, such as salary, bonuses, and endorsements. Changes in his playing time, team performance, or endorsement deals can impact his income and, consequently, his net worth.

- Investment Performance: Domi has invested in various assets, including stocks, bonds, real estate, and business ventures. The performance of these investments can fluctuate due to market conditions and economic factors, leading to gains or losses that affect his net worth.

- Lifestyle Expenses: Domi's personal spending habits can also impact his net worth. Major purchases, such as luxury cars or real estate, can reduce his net worth, while saving and budgeting can help increase it over time.

- Taxes and Liabilities: Changes in tax laws or unexpected expenses, such as medical bills or legal fees, can also affect Domi's net worth. Managing liabilities and planning for taxes can help mitigate their negative impact.

Understanding the factors that contribute to net worth fluctuations is crucial for Domi to make informed financial decisions and safeguard his wealth. By carefully managing his income, expenses, and investments, he can navigate these fluctuations and maintain a strong financial position.

Comparison to other athletes

Assessing Tie Domi's net worth often involves comparing it to the net worth of other athletes, providing context and insights into his financial standing within the sports industry. This comparison encompasses several key facets:

- Contractual Earnings: Comparing Domi's salary, bonuses, and endorsement deals to those of other players in the NHL reveals his relative earning power and market value.

- Investment Returns: Evaluating the performance of Domi's investments against those of other athletes highlights his financial acumen and risk tolerance.

- Lifestyle Expenses: Comparing Domi's spending habits to those of his peers sheds light on his financial priorities and personal choices.

- Long-Term Planning: Assessing Domi's financial planning strategies in comparison to other athletes provides insights into his approach to securing his financial future.

Understanding these comparative aspects offers a comprehensive view of Tie Domi's net worth, allowing us to gauge his financial success relative to others in the industry. It also serves as a valuable tool for financial planning, enabling Domi to benchmark his progress and make informed decisions about his future.

Frequently Asked Questions (FAQs) about Tie Domi Net Worth

This FAQ section provides concise answers to common questions and clarifies key aspects related to Tie Domi's net worth.

Question 1: How much is Tie Domi's net worth?

Answer: Tie Domi's net worth is estimated to be around $12 million, according to various reputable sources.

Question 2: What are the primary sources of Tie Domi's income?

Answer: Domi's income primarily comes from his NHL salary, bonuses, endorsement deals, and business ventures.

Question 3: How has Tie Domi's net worth changed over time?

Answer: Domi's net worth has fluctuated over the years due to changes in his income, expenses, and investment performance.

Question 4: How does Tie Domi manage his finances?

Answer: Domi has a team of financial advisors who assist him in managing his finances, including investments and tax planning.

Question 5: What is Tie Domi's investment strategy?

Answer: Domi's investment strategy involves a diversified portfolio of stocks, bonds, real estate, and alternative investments.

Question 6: How does Tie Domi's net worth compare to other NHL players?

Answer: Domi's net worth is comparable to other NHL players who have had successful careers and made wise financial decisions.

These FAQs offer a glimpse into the various facets of Tie Domi's net worth and provide insights into his financial success. Understanding these aspects is crucial for gaining a comprehensive view of his financial standing.

The following section will delve deeper into the strategies and decisions that have contributed to Tie Domi's financial success, offering valuable lessons for financial planning and wealth management.

Tips for Building a Strong Financial Foundation

Building a strong financial foundation requires careful planning and sound financial practices. Here are some actionable tips to help you achieve your financial goals:

Tip 1: Create a budget and stick to it: A budget helps you track your income and expenses, ensuring that you live within your means and avoid overspending.

Tip 2: Save regularly: Make saving a priority by setting aside a portion of your income each month, regardless of how small.

Tip 3: Invest wisely: Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to spread your risk and potentially increase your returns.

Tip 4: Manage your debt effectively: Keep your debt under control by prioritizing high-interest debts and consolidating your loans to reduce interest costs.

Tip 5: Plan for retirement early: Start saving for retirement as early as possible to take advantage of compound interest and secure your financial future.

Tip 6: Seek professional advice: Consult with a financial advisor to get personalized guidance and make informed financial decisions.

Tip 7: Stay informed: Keep up-to-date with financial news and trends to make informed investment decisions and stay ahead of potential financial challenges.

Tip 8: Be patient and disciplined: Building a strong financial foundation takes time and effort. Stay patient and disciplined with your financial habits, and you will reap the rewards in the long run.

Following these tips can help you establish a sound financial foundation, achieve your financial goals, and secure your financial well-being.

The next section will explore the importance of financial planning in more detail, providing insights and strategies for effective financial management.

Conclusion

This comprehensive exploration of Tie Domi's net worth has shed light on the various factors that have contributed to his financial success. Key takeaways include the importance of diversifying income streams, managing expenses and liabilities effectively, and making wise investment decisions. Domi's financial journey highlights the significance of sound financial planning and strategic decision-making in building a strong financial foundation.

As we navigate an ever-changing financial landscape, it is imperative to learn from the strategies of successful individuals like Tie Domi. By embracing responsible financial habits and seeking professional guidance when needed, we can empower ourselves to achieve our own financial goals and secure our financial well-being.

How To Build Wealth Like Anabelle Acosta: A Guide For Aspiring Actors And Entrepreneurs

Unveiling The Wealth Of Steven Mackintosh: A Financial Biography

How T%c3%balio Maravilha's Net Worth Impacts His Legacy

ncG1vNJzZmirpaWys8DEmqRsZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmatoZVisbC5yGalnqxdrLyzwMdnn62lnA%3D%3D