A Guide For Biography Writers

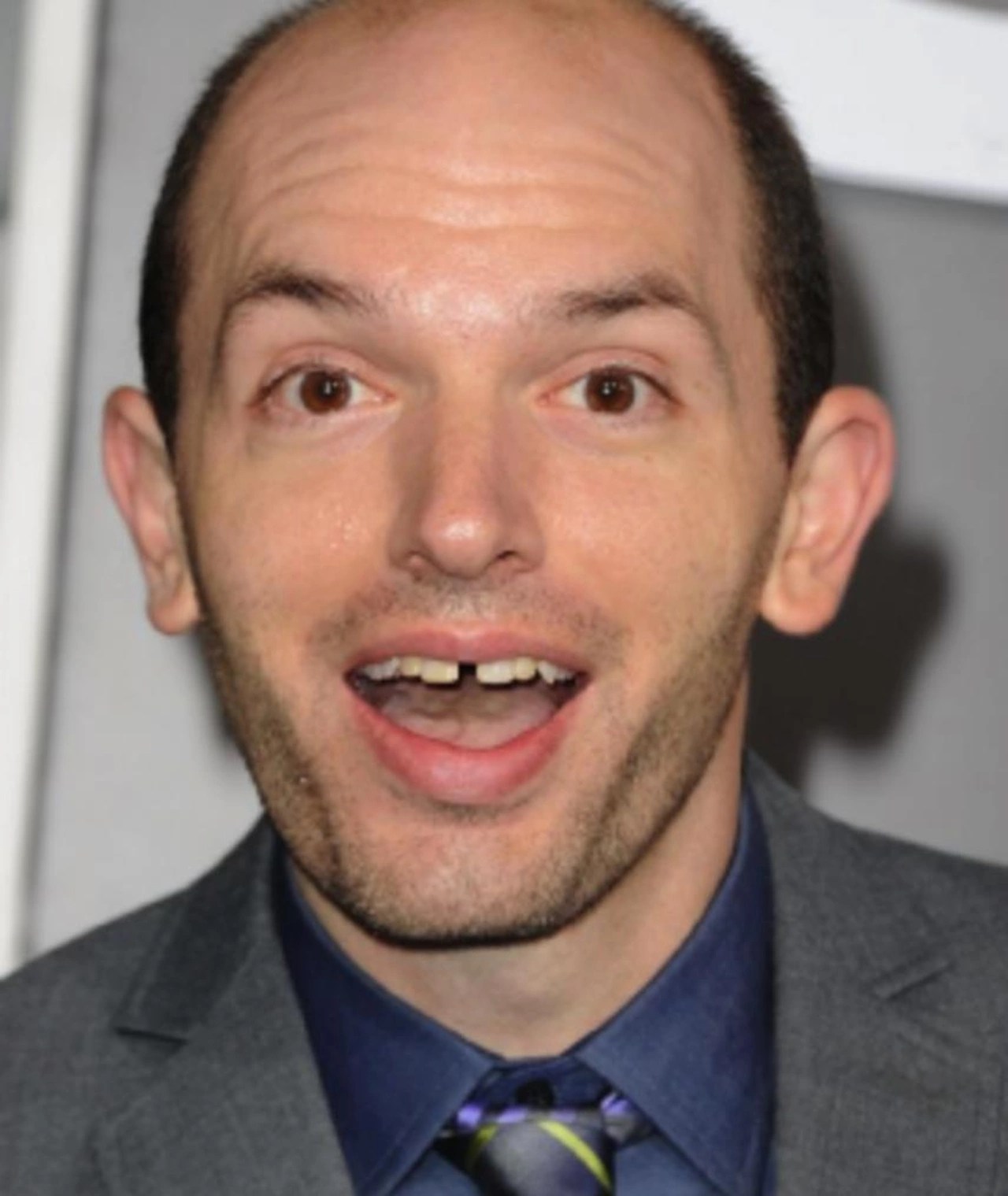

Paul Scheer Net Worth represents the total assets and financial value of the American actor, comedian, writer, producer, and podcaster, Paul Scheer.

Assessing an individual's net worth is important for understanding their financial well-being and success, as it reflects their earning potential, investments, and wealth accumulation over time. Historically, the concept of net worth has been tied to assessing an individual's creditworthiness and financial stability.

This article will provide a comprehensive overview of Paul Scheer's net worth, exploring his income sources, investments, spending habits, and overall financial journey.

Paul Scheer Net Worth

Exploring Paul Scheer's net worth involves examining various key aspects that contribute to his overall financial standing and wealth accumulation.

- Income Sources

- Investments

- Assets

- Liabilities

- Equity

- Spending Habits

- Financial Planning

- Tax Implications

These aspects provide insights into Scheer's earning potential, investment strategies, financial obligations, wealth distribution, lifestyle choices, and overall financial management. Understanding these elements offers a comprehensive view of his net worth and its contributing factors.

Income Sources

Understanding Paul Scheer's income sources is crucial for assessing his net worth, as it provides insights into the various streams of revenue that contribute to his overall wealth. These sources encompass a range of activities and investments that generate income over time.

- Acting: Scheer's primary source of income stems from his successful acting career in film, television, and theater. His notable roles in shows like "The League" and "Veep" have significantly contributed to his net worth.

- Comedy: As a stand-up comedian, Scheer performs live shows and releases comedy specials, generating additional income through ticket sales and streaming platforms.

- Producing: Scheer has ventured into producing, both independently and through collaborations. His involvement in projects like "The Good Place" and "Fresh Off the Boat" has expanded his income streams.

- Podcasting: Scheer co-hosts several popular podcasts, including "How Did This Get Made?" and "Unspooled." These podcasts generate revenue through advertising, sponsorships, and premium content.

The diversity of Paul Scheer's income sources highlights his entrepreneurial spirit and ability to capitalize on his talents and interests. These various streams of revenue contribute significantly to his overall financial stability and net worth growth.

Investments

Investments play a critical role in shaping Paul Scheer's net worth. By allocating a portion of his income towards investments, Scheer seeks to grow his wealth over time and generate passive income streams. Investments encompass a wide range of assets, including stocks, bonds, real estate, and private equity. Each investment type carries its own risk and return profile, allowing Scheer to diversify his portfolio and mitigate potential losses.

One notable investment for Scheer has been his involvement in the real estate market. He has purchased and renovated several properties, generating rental income and capital appreciation over time. Additionally, Scheer has invested in various startups and venture capital funds, leveraging his industry connections and knowledge to identify promising investment opportunities.

Understanding the connection between investments and Paul Scheer's net worth is crucial for assessing his financial health and long-term wealth accumulation strategy. Investments serve as a means to multiply wealth, generate passive income, and hedge against inflation. Scheer's savvy investment decisions have significantly contributed to his overall net worth and financial security.

Assets

Assets play a pivotal role in determining Paul Scheer's net worth, representing the resources and valuables he owns. Assets can be categorized into various types, including tangible assets such as real estate, vehicles, and artwork, as well as intangible assets such as intellectual property, patents, and investments. These assets hold monetary value and contribute to an individual's overall financial standing.

The connection between assets and Paul Scheer's net worth is direct and significant. Assets serve as a store of value, appreciating or depreciating over time, which impacts Scheer's net worth. For instance, if the value of his real estate investments increases, his net worth will rise accordingly. Conversely, if the value of his stock portfolio declines, his net worth will be negatively affected.

Understanding the relationship between assets and Paul Scheer's net worth is crucial for several reasons. Firstly, it provides insights into his financial stability and overall wealth. Secondly, it highlights the importance of asset diversification, which reduces risk and enhances the preservation of wealth. Thirdly, it emphasizes the role of financial planning and investment strategies in managing and growing assets over time.

In summary, assets are a critical component of Paul Scheer's net worth, providing a snapshot of his financial well-being and wealth accumulation. By understanding the relationship between assets and net worth, individuals can make informed financial decisions, optimize their investment strategies, and achieve long-term financial success.

Liabilities

Liabilities are obligations or debts owed by an individual or organization, representing claims against their assets. Within the context of Paul Scheer's net worth, liabilities play a crucial role in determining his overall financial health and stability.

- Mortgages: These are loans secured by real estate, commonly used to finance the purchase of a home or investment property. Mortgage payments, including principal and interest, constitute a significant liability.

- Loans: Personal loans, business loans, or lines of credit represent borrowed funds that must be repaid with interest. They can be used for various purposes, such as education, business ventures, or personal emergencies.

- Taxes: Liabilities arise from unpaid taxes, such as income tax, property tax, or sales tax. Failure to settle tax obligations can result in penalties and legal consequences.

- Credit Card Debt: Unpaid credit card balances accumulate interest charges, increasing the overall debt burden. High credit card debt can negatively impact credit scores and limit access to future financing.

Understanding the various facets of liabilities is essential for assessing Paul Scheer's net worth. Liabilities represent financial obligations that must be met, and they can affect his cash flow, investment decisions, and overall financial well-being. By considering both assets and liabilities, a more comprehensive view of his financial position can be obtained.

Equity

Within the context of "Paul Scheer Net Worth," equity represents the residual value of assets after deducting liabilities. It reflects the portion of assets that Scheer owns outright and serves as a key indicator of his financial health and overall net worth.

- Ownership Interest: Equity represents Scheer's ownership stake in various assets, such as his production company, real estate investments, and any other ventures where he holds a share.

- Home Equity: This refers to the portion of his primary residence or any other real estate properties that Scheer owns outright, calculated as the difference between the property's market value and any outstanding mortgage balance.

- Investment Equity: This encompasses the value of Scheer's investments in stocks, bonds, mutual funds, and other financial instruments, representing his ownership stake in various companies and ventures.

- Intellectual Property Equity: As a creative professional, Scheer may own copyrights or trademarks related to his works, contributing to his overall equity and potential income streams.

Understanding the various components of equity is crucial for assessing Paul Scheer's net worth. Equity represents the value of his assets that are not encumbered by debt, providing insights into his financial stability, investment strategies, and overall wealth accumulation. By analyzing equity in conjunction with other aspects of his net worth, a comprehensive view of his financial position can be obtained.

Spending Habits

Paul Scheer's spending habits play a significant role in shaping his net worth. They influence how he allocates his income and the lifestyle choices he makes, ultimately affecting his financial trajectory.

- Discretionary Spending: This encompasses expenses that are not essential for basic living, such as entertainment, dining out, and travel. Scheer's spending habits in this category can provide insights into his personal interests and priorities.

- Investments: Scheer's investment decisions, whether in stocks, real estate, or other ventures, can significantly impact his net worth over time. Understanding his spending habits related to investments sheds light on his risk tolerance and financial goals.

- Debt Management: Scheer's spending habits regarding debt repayment, such as credit card balances or loans, influence his financial stability and overall net worth. Responsible debt management can improve his cash flow and reduce interest expenses.

- Charitable Giving: Scheer's charitable contributions reflect his philanthropic values and can impact his tax liability. Understanding his spending habits in this area provides insights into his commitment to giving back to the community.

By examining these facets of Paul Scheer's spending habits, we gain a deeper understanding of his financial decision-making and its impact on his net worth. Responsible spending, balanced with strategic investments and debt management, can contribute to long-term financial stability and wealth accumulation.

Financial Planning

Financial planning is an indispensable aspect of understanding Paul Scheer's net worth and his overall financial well-being. It involves a comprehensive strategy to manage income, expenses, and investments, with the goal of achieving financial security and long-term wealth accumulation.

- Income Management: This involves optimizing income sources, including maximizing earnings and exploring additional revenue streams. Scheer's diverse income portfolio, spanning acting, comedy, producing, and podcasting, reflects his strategic income management approach.

- Expense Optimization: Responsible spending and expense management are crucial for preserving and growing wealth. Scheer's spending habits, including discretionary expenses, investments, and debt management, provide insights into his financial discipline.

- Investment Strategy: Financial planning involves making informed investment decisions based on risk tolerance and financial goals. Scheer's real estate investments, venture capital involvement, and stock portfolio diversification demonstrate his strategic investment approach.

- Tax Planning: Minimizing tax liabilities is an essential part of financial planning. Scheer's charitable contributions and retirement savings strategies reflect his proactive approach to tax planning.

By considering these facets of Paul Scheer's financial planning, we gain a deeper understanding of how he manages his wealth. His disciplined approach to income management, expense optimization, investment strategy, and tax planning contributes significantly to his overall net worth and financial stability.

Tax Implications

Tax implications play a significant role in shaping Paul Scheer's net worth. Understanding the connection between taxes and his financial standing is crucial for assessing his overall wealth management strategy and financial well-being.

Tax implications arise from various sources of income, including acting, comedy, producing, and podcasting. Each income stream is subject to specific tax rates and regulations, affecting Scheer's net worth by reducing his disposable income. Effective tax planning becomes essential to minimize tax liabilities and optimize his financial position.

For instance, Scheer's investments in real estate and venture capital are influenced by tax considerations. Rental income from real estate properties is subject to income tax, while capital gains from property sales or venture capital investments are taxed differently. Understanding these tax implications allows Scheer to make informed decisions about his investments, balancing potential returns with tax efficiency.

In summary, tax implications are an integral component of Paul Scheer's net worth, impacting his overall financial health. By considering the tax implications of his income sources and investments, Scheer can optimize his financial strategy, reduce tax liabilities, and preserve his wealth over the long term.

FAQs on Paul Scheer Net Worth

This section addresses frequently asked questions and clarifies essential aspects regarding Paul Scheer's net worth, providing a comprehensive understanding of his financial standing.

Question 1: What is Paul Scheer's estimated net worth?

With a successful career spanning various entertainment domains, Paul Scheer's net worth is estimated to be around $16 million, as of [insert year].

Question 2: What are the primary sources of Paul Scheer's income?

Scheer's income primarily stems from acting, comedy shows, producing, podcasting, and various investments.

Question 3: How does Paul Scheer invest his earnings?

Scheer has diversified his investments, including real estate, stocks, and venture capital, to generate passive income and grow his wealth.

Question 4: What role does financial planning play in Paul Scheer's net worth?

Scheer's financial planning encompasses income management, expense optimization, investment strategy, and tax planning, contributing to his overall financial stability.

Question 5: How do taxes impact Paul Scheer's net worth?

Scheer's income and investments are subject to various tax implications, which he strategically manages to minimize liabilities and preserve his wealth.

Question 6: What are some key factors that have contributed to Paul Scheer's financial success?

Scheer's diverse income streams, savvy investments, responsible spending habits, and effective financial planning have collectively propelled his financial growth.

These FAQs provide insights into the various aspects that shape Paul Scheer's net worth, highlighting the importance of income diversification, strategic investments, and prudent financial management for long-term wealth accumulation.

Understanding these factors can serve as valuable lessons for individuals seeking to build and preserve their own financial well-being.

Tips to Enhance Your Financial Well-being

The following tips provide practical guidance to help you improve your financial standing and work towards long-term financial success.

Tip 1: Establish a Budget and Track ExpensesCreate a comprehensive budget to monitor your income and expenses, identifying areas where you can optimize spending and save more.Tip 2: Increase Your Income StreamsExplore additional income sources through side hustles, investments, or skill development to supplement your primary income.Tip 3: Invest Wisely and Diversify Your PortfolioAllocate a portion of your income to investments, such as stocks, bonds, or real estate, and spread your investments across different asset classes to mitigate risk.Tip 4: Reduce Debt and Avoid Unnecessary BorrowingPrioritize paying off high-interest debt and limit taking on new debt to improve your credit score and reduce financial stress.Tip 5: Plan for Retirement EarlyStart saving for retirement as early as possible to take advantage of compound interest and secure your financial future.Tip 6: Seek Professional Financial AdviceConsult with a qualified financial advisor to gain personalized guidance and develop a tailored financial plan that aligns with your goals.By implementing these tips, you can gain control of your finances, make informed decisions, and build a solid foundation for financial well-being.

These tips lay the groundwork for financial success, empowering you to navigate financial challenges and achieve your long-term financial aspirations.

Conclusion

In exploring Paul Scheer's net worth, we delve into the multifaceted aspects that contribute to his financial standing. The examination of income sources, investments, assets, liabilities, and spending habits provides insights into his financial decision-making and overall wealth management strategy. Furthermore, the role of financial planning and tax implications underscores the importance of strategic financial management for long-term success.

Key takeaways include the significance of income diversification, strategic investments, and prudent financial planning in building and preserving wealth. Paul Scheer's net worth serves as a testament to the power of a well-rounded financial approach that encompasses both professional endeavors and savvy financial management. Understanding the principles behind his financial success can empower individuals to make informed decisions and work towards their own financial well-being.

How To Build A Strong Net Worth Like Brittany Martin

How To Build A Million-Dollar Net Worth Like Michelle Burke: A Step-by-Step Guide

How To Build A Net Worth Like Mr Booshot

ncG1vNJzZmirpaWys8DEmqRrZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmapmaWherSvx56cq2WemsFuw86rq6FmmKm6rQ%3D%3D